Previously, we identified the latest FinTech trends and how they will impact your career. Given the trends of digital transformation and changing customer expectations, banks have had to transform their businesses to stay relevant. New competition from FinTechs, digital banks, and mobile-only banks posed new challenges to traditional banks. Although traditional banks offer the same types of services as digital banks, there are some key differences that differentiate the two and make one more attractive than the other.

- Internal organization of banks

The internal organization of businesses will inform the type of culture, level of efficiency and productivity of its employees. Traditional banks have a rigid organizational structure with a complex chain of command.

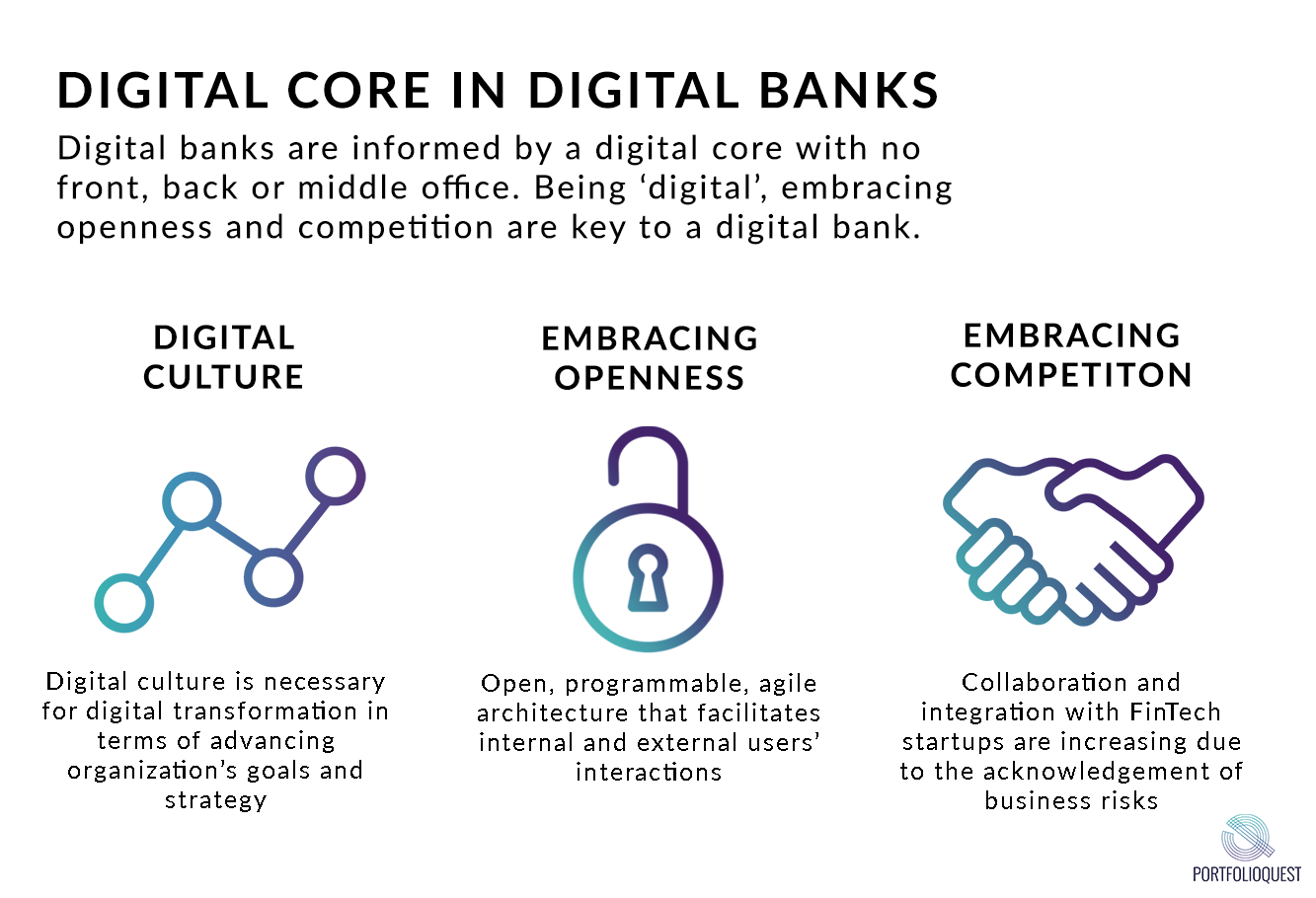

Digital banks, on the other hand, are informed by a digital core with no front, back or middle office. According to BCG, nearly 80% of the companies that focused on culture sustained strong performance. Being a digital bank is not just about having digital capabilities but rather inculcating ‘digital’ as a culture. For example, having an open, programmable and agile IT architecture allows the bank to become truly digital. This openness will become more of the norm in the next 5 to 10 years. Moreover, banks are slowly collaborating with FinTech startups to improve services and products that are ultimately provided to the end customer.

The kinds of people who will thrive in such an environment will have to be digitally inclined, open and adaptable to the constant change. Apart from analytical skills, employees will need to keep up to date with the latest digital trends and understand its impact on the business as a whole.

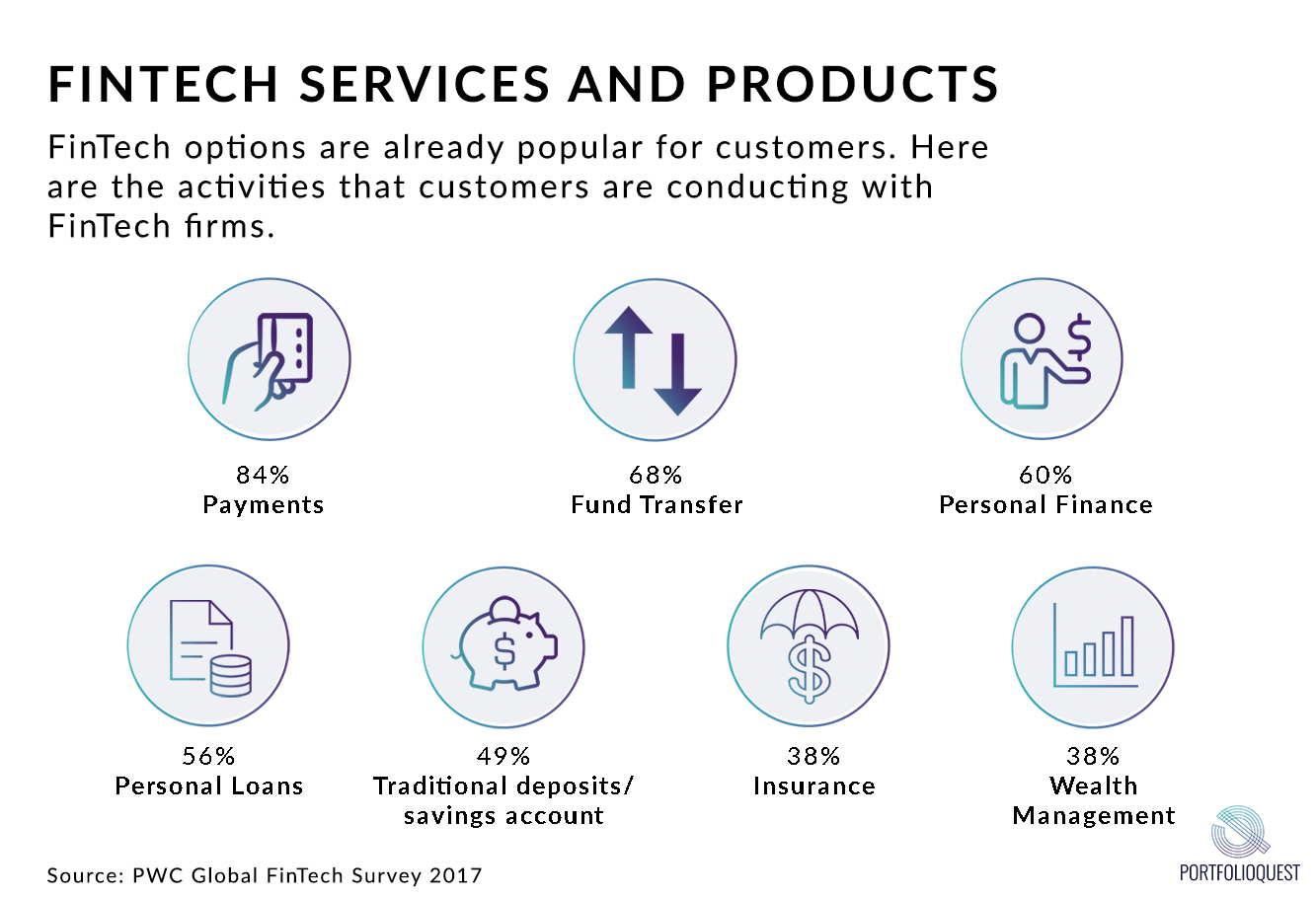

- Type of products and services offered

Traditional banks and digital banks offer similar services, the difference stems from the processes and platforms utilized. Legacy, paper-based products, services and processing are brought to the web in traditional banks. In contrast, digital banks offer instant, fully automated products and services, which provides ease of access as well as convenience. Digital banks also offer new types of products such as peer to peer lending and cryptocurrencies.

For example, Revolut offers free international money transfers and short-term personal loans at very competitive rates with instant notifications. Besides offering digital services, some banks are fully digital. Starling Bank is a mobile-only bank offering money transfers, personal loans all accessible via the mobile app. Some digital banks also offer a combination. For example, N26 offers a checking account with debit card, cash withdrawals at ATMs and a rewards program.

Increasing automation will mean that employees need to be upskilled and retrained about the digital offerings of banks to remain relevant and valuable. Given the fast-paced environment, employees will need to be agile and proactive in adapting to the changes in the company. It would be useful to have some general knowledge about new technologies and innovation used in the banking space.

- Customer relationship with banks

Long queues are perhaps the most characteristic of traditional banks. However, at a digital bank, customers’ relationship with the bank starts and stays strictly online. According to an Accenture survey, nearly all (91%) of banking leaders surveyed agree that new technologies are dramatically changing the way they engage with customers. 86% reports that mobile, digital payments, online are the top overall technology investment priorities. Moreover, customers are very concerned with the quality of service at their banks. Accenture notes that 45% are willing to pay more for a better customer service and 68% of consumers will not go back once they have switched providers.

This points towards the importance of increasing the digitalization capacity of employees. Additional skills that are required for one to be involved in digital projects are useful since it enables one to effectively engage in customer-facing roles or supporting functions.

In conclusion, besides the technical know-how, adopting an open and forward thinking mindset is crucial in making you a valuable contributor in the digital transformation.

In the next post, we will dive into greater detail about the key aspects of digital banking and the skill sets needed in the digital transformation.

Pingback: Future-Enabled Digital Banking Skill Sets You Need to Have