Are you skilled at managing credit portfolios?

Try our simulation and find out today.

Products

Wide spectrum of solutions

Increase learning engagement through gamification. Gain knowledge in FinTech and RegTech in the digital banking world. Successfully operate the most profitable virtual bank with the most satisfied customers.

Select a Solution

Learn through gamification. Select from 4 solutions.

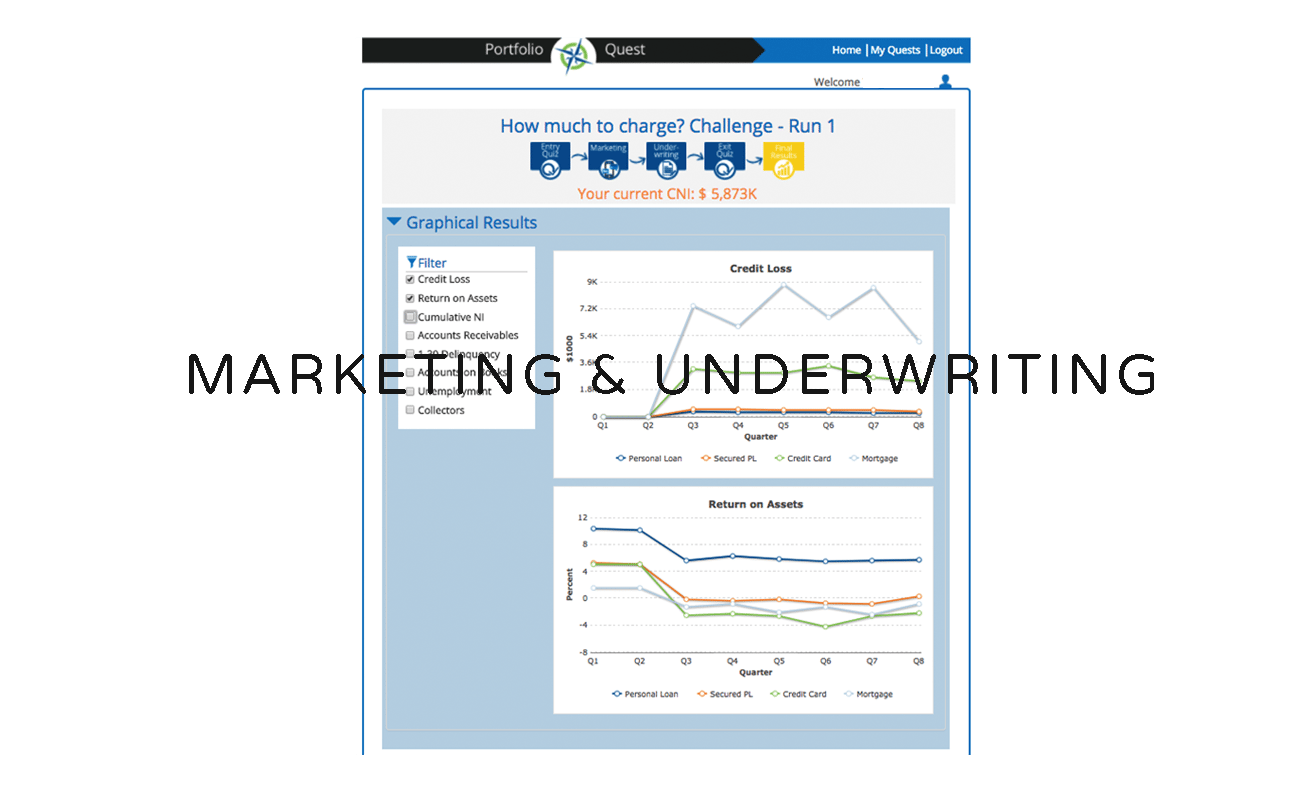

Marketing and Underwriting

Deploy a limited marketing budget to attract the best customers to your consumer lending portfolio. Create an approval, pricing and exposure strategy for personal loans, credit cards, mortgages and small business loans. Develop Profit & Loss management and product strategy skills.

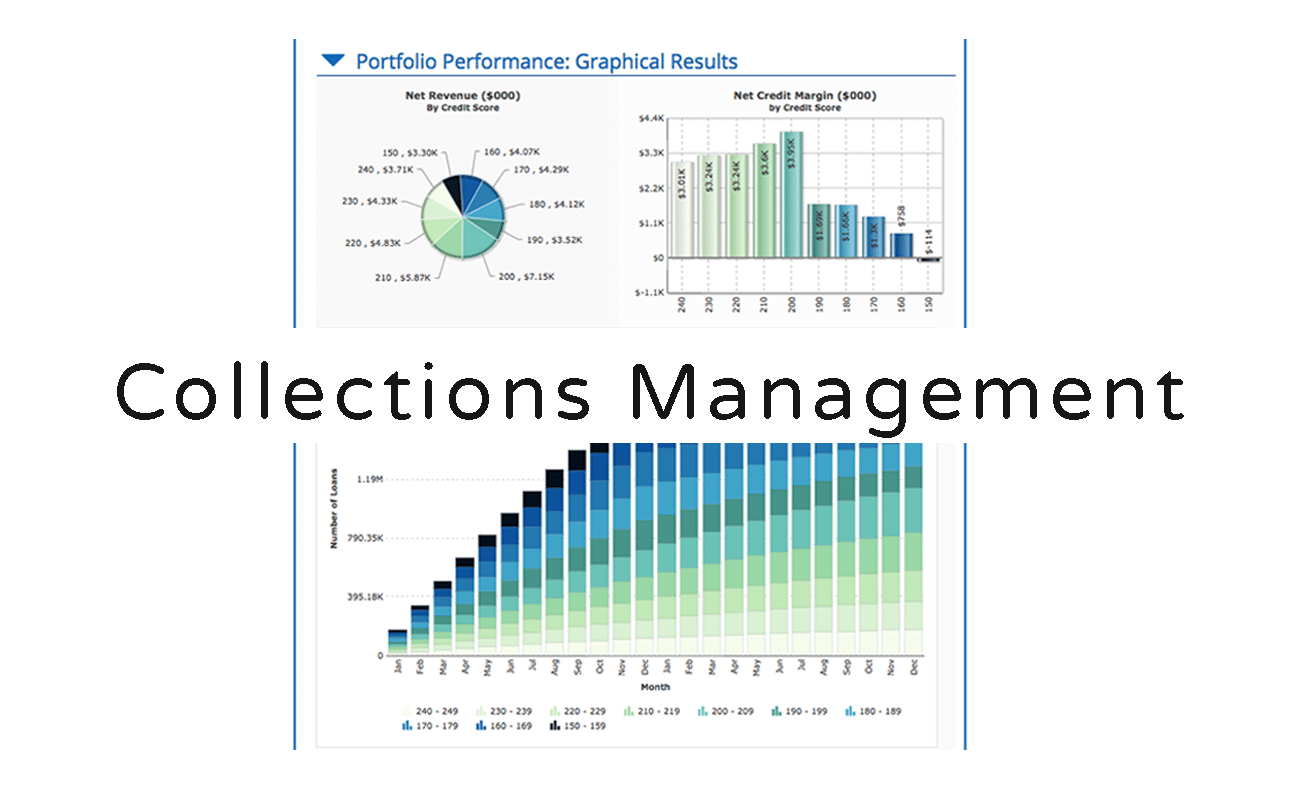

Collections

Design and test collection severity strategies for an unsecured loans portfolio, varying your approach by customer risk group. Optimize automation and recovery systems investments and hone your workload capacity forecast. Develop data science, experimental design and analytic skills.

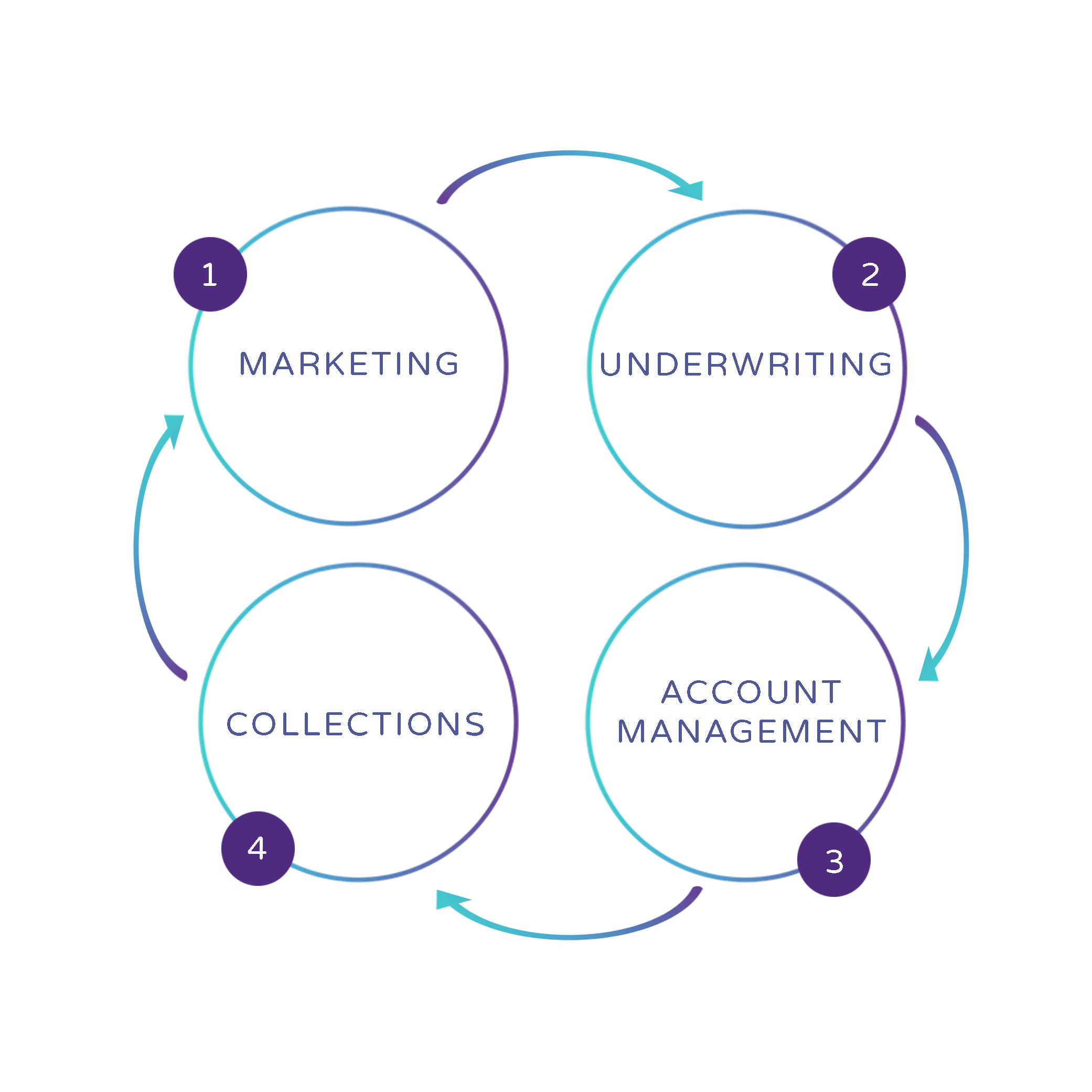

Credit Life Cycle

Create and manage the most profitable virtual bank with the most satisfied customers. Determine loan approval, pricing and exposure, balancing risk and reward. Manage the end to end process, from marketing to underwriting, through to collections. Develop data science, portfolio management and subject matter skills.

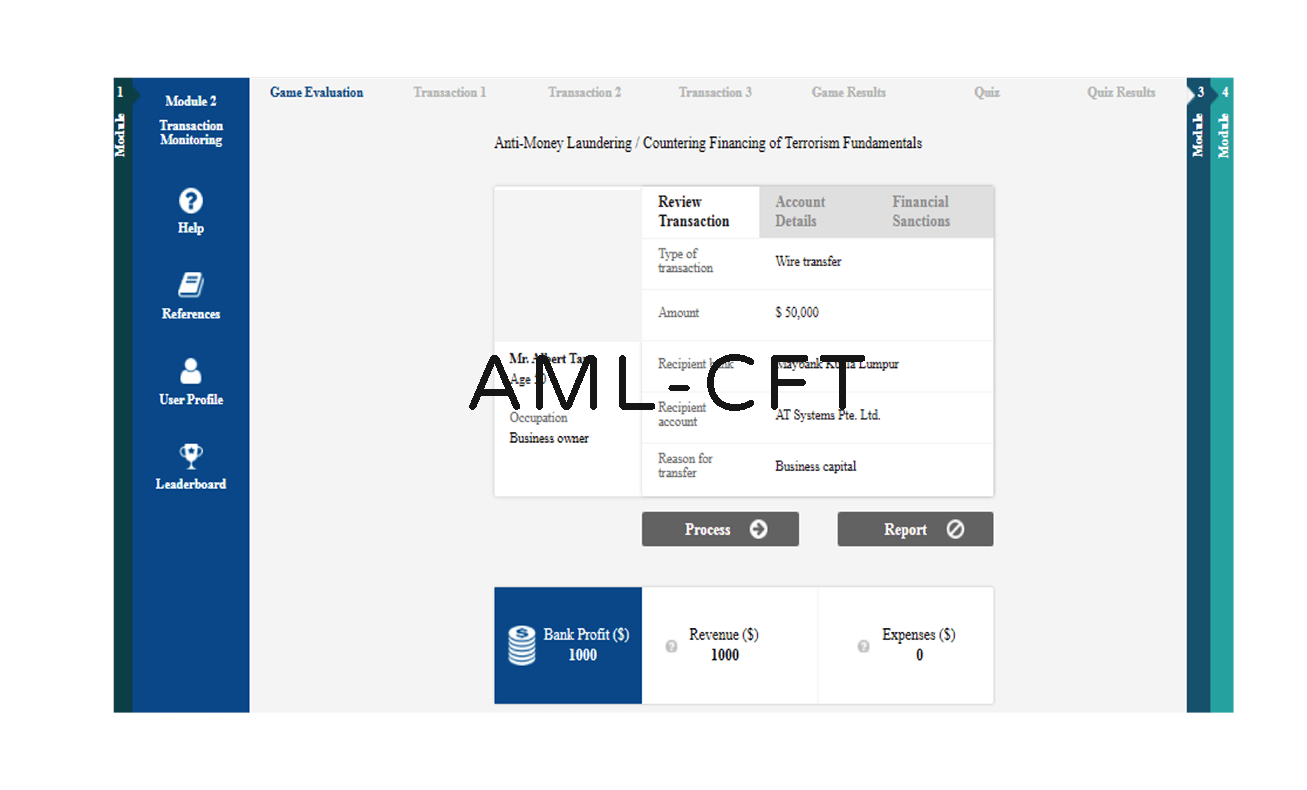

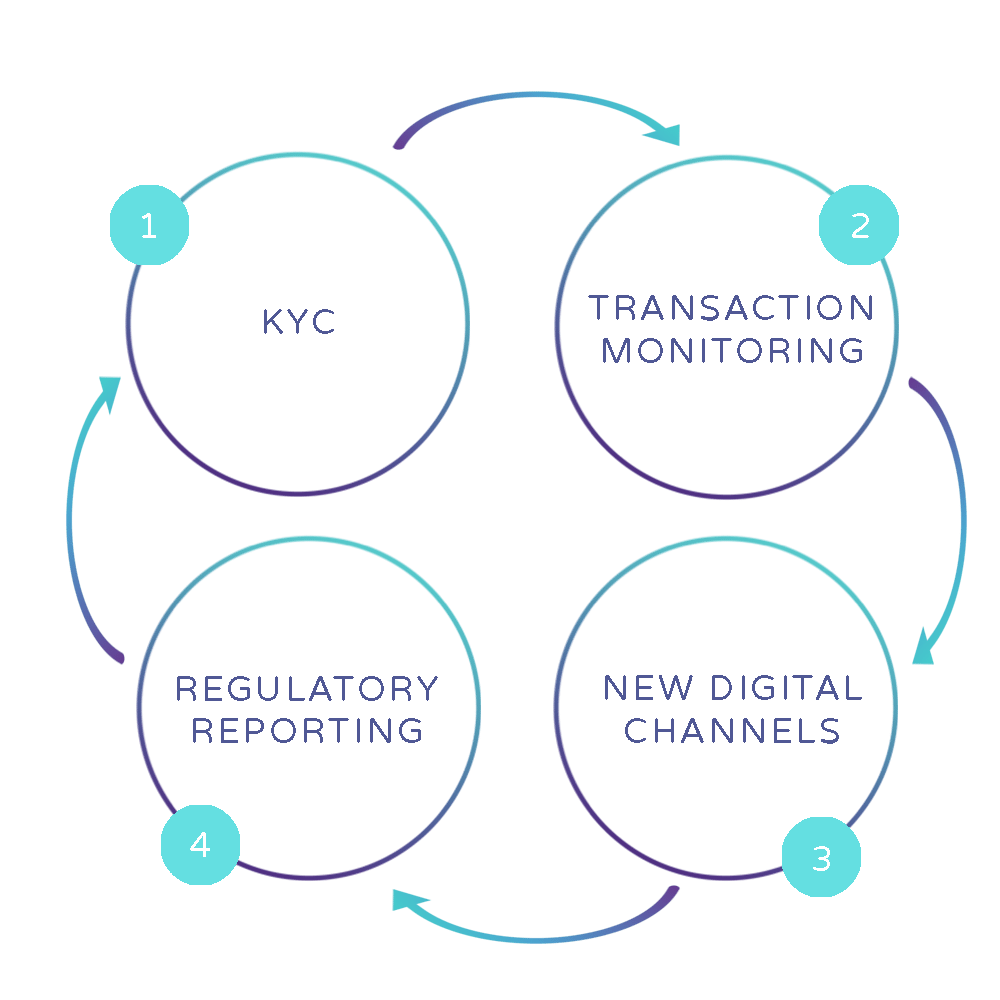

AML/CFT

Review transactions based on real time typologies derived from machine learning outputs. Identify suspicious transactions within the chosen regulatory regime.

FinTech in Consumer Lending

RegTech in AML-CFT

1

- E-KYC Tools

- Biometric Identity

- Machine Learning/AI

- Data Consortiums

4

API data feeds from firms to supervisory authority

2

- Activity Monitoring Tools

- Machine Learning/AI

- Data Consortiums

3

Real time transaction monitoring

Level of Difficulty

Simulations are targeted to cater to different job roles and levels of experience.

Fundamentals

All Level Employees

0 -3 years of experience

Certification

Mid Level Employees

3 - 10 years of experience

Mastery

Senior Level Employees

10+ years of experience